News & Events

Find an ATM

Find a NO-FEE MoneyPass ATM near you.

Find a Branch

Locate a branch near you or call

Your New Year Resolution: Improve Your Credit Score

Posted

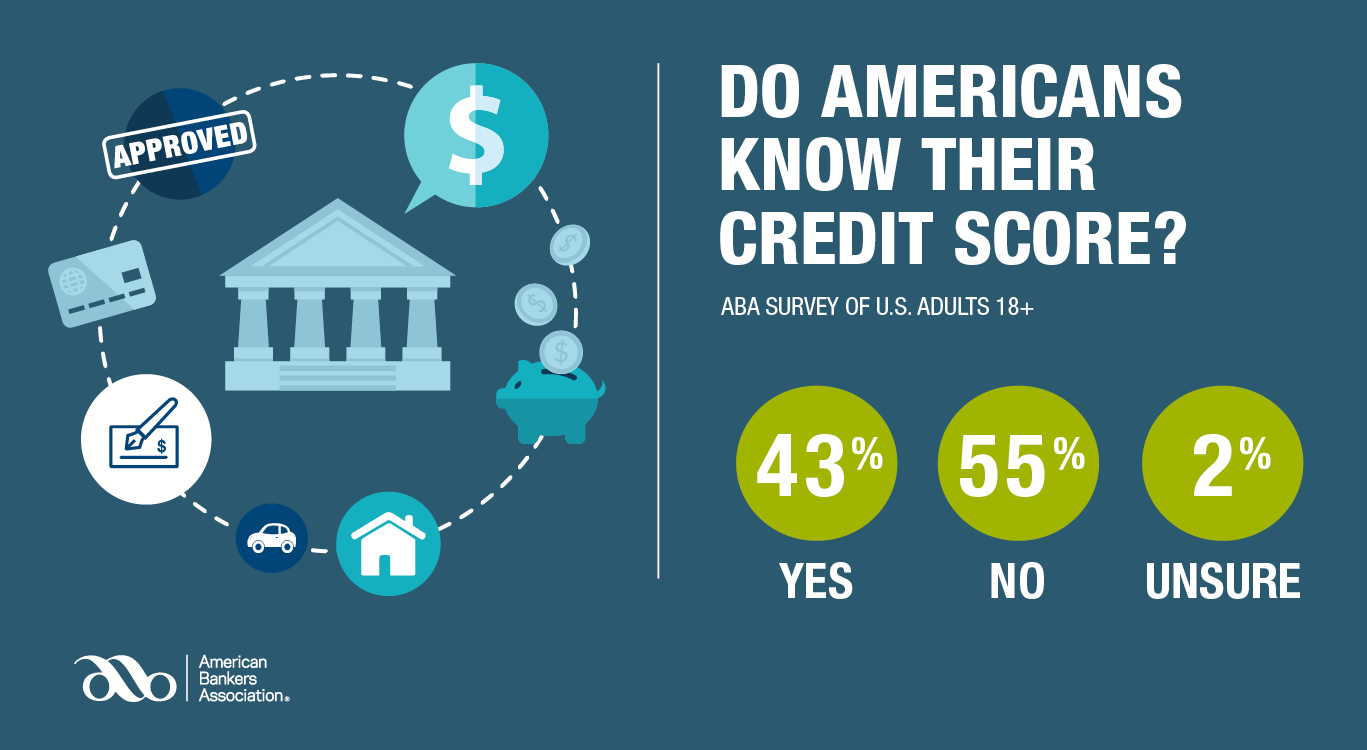

Forty-three percent of consumers know their credit score, a key metric that helps determine whether they can get credit cards, auto loans, mortgages and insurance coverage, according to a recent survey by the American Bankers Association. Whether or not you know your score, you can take action now to understand and protect your credit.

“The more you know about your own credit history, the better you can position yourself for lower rates when applying for a loan or insurance coverage,” said Nessa Feddis, the American Bankers Association’s senior vice president and deputy chief counsel for consumer protection and payments.

Credit scores are reflective of a person’s creditworthiness and are based on their credit reports, which indicate whether a person pays their bills on time. Lenders use a consumer’s credit score to decide whether to lend them money and at what rate. Credit scores are also used by organizations for screening insurance and other applications. Consumers receive their credit score when they apply for a mortgage, if they are turned down for credit or if a bank used their credit score to determine their interest rate.

“If you check your score and don’t like what you see, you can take action today to begin improving it,” said Feddis. “While there is no overnight fix for a low credit score, paying your debts on time and demonstrating that you can manage credit responsibly can help you gradually rebuild your score.”

Below are tips from the American Bankers Association to help you improve and maintain your credit score:

Credit Do’s:

- DO order a copy of your credit report annually. The three major credit bureaus are required to provide you with a free copy of your credit report at your request each year. To get a free copy of your credit report, visit www.annualcreditreport.com or call 1-877-322-8228. You can also obtain your credit score from any of these credit bureaus for a reasonable fee.

- DO know the power of credit. Banks look at your credit history as an indication of your future financial behavior. By using credit wisely, you can build a good credit history making it easier to get loans with low interest rates, rent an apartment, purchase a car or home, and may even help you get a job.

- DO read the fine print on the credit application. The application is a contract, so read it carefully before signing. Credit card companies are very competitive so interest rates, credit limits, grace periods, annual fees, terms and conditions may vary.

- DO pay at least the minimum due and contact your creditor if you have trouble making payments. This will help you to avoid late fees and a rising APR. To pay off your balance more quickly, pay more than the minimum due. If you are unable to make the minimum monthly payments, let your creditor know so they can work with you to create a more manageable payment plan.

- DO be wary of anyone who claims they can “fix” your credit report. No one can legally remove negative information from your credit history if it is accurate. The only thing that can fix a credit report is time and a positive payment history.

Credit Don’ts:

- DON’T pay your bills late. Late payments can affect your credit rating and increase your balance. If you are unable to pay the minimum monthly payment, let your creditor know and it may be able to lower your payments.

- DON’T spend more than you can afford. Credit is a loan and has to be repaid. It is your responsibility to manage your debts and to keep your commitment with lenders. Avoid reaching your credit limit or “maxing out” your cards.

- DON’T ignore the warning signs of credit trouble. If you pay only the minimum balance, pay late, use cash-advances to fund daily living expenses or transfer a lot of balances you might be in the credit “danger zone.” Talk to a non-profit financial counseling organization like the National Foundation for Credit Counseling (www.nfcc.org) to regain control of your finances.

- DON’T share your credit card number. Never give out credit card or personal information if you have not initiated the transaction. Be aware of identity theft and phishing scams that ask for credit card numbers. If you suspect that your identity has been compromised, call your bank and file a complaint with the Federal Trade Commission at 1-877-ID-THEFT (1-877-438-4338) or www.identitytheft.gov/#/.

For more tips and resources on this and other personal finance topics, visit aba.com/consumers.