Positive Pay

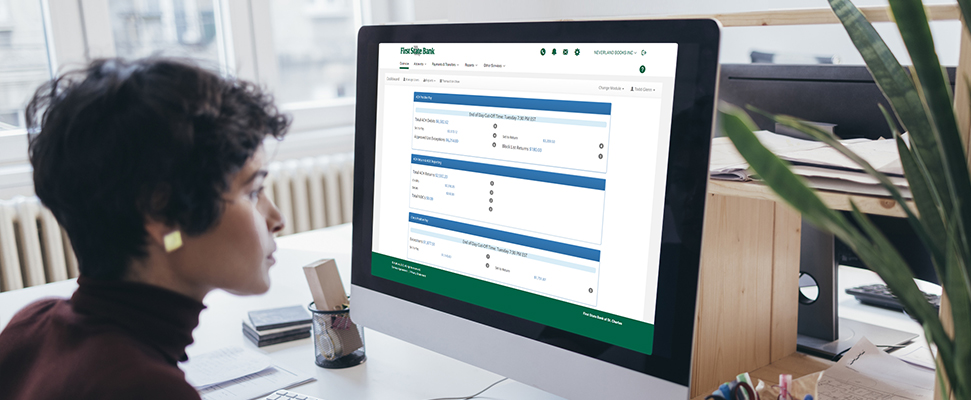

Protecting your accounts from scammers and fraudsters can be a daily challenge for business owners who need to act fast and monitor every transaction. First State Bank’s Positive Pay offers a crucial service to business checking customers that helps you identify and prevent fraudulent transactions from being processed.

Positive Pay Check Fraud Protection

First State Bank makes it easy for you to protect your account against the expense and hassle of forged and fraudulent checks clearing your account. No matter how big or small your business is, if you use ACH debits, credits, or checks, you’ll benefit from the security Positive Pay brings.

Help guard against the following types of check fraud:

- Counterfeit checks

- Altered Checks

- Payee

- Dollar amount

- Forged signature

- Stolen blank checks

Streamline the Review of Check Discrepancies

Positive Pay helps prevent outside unauthorized checks from being paid while reducing time spent validating check transactions. To expedite the review of a large volume of checks, simply upload a file containing information on checks you have issued. Positive Pay then compares checks for payment against the check data you supplied. You are then notified of check discrepancies and can determine whether to pay or return the check.

Business-Critical Benefits

- Receive automated alerts when check exceptions are presented for decisioning

- Seamlessly access Positive Pay through digital banking

- Leverage flexible issue file mapping templates

- Easily view issue file status, perform file reversals, and modify issue items

- Automate actions with default pay/return settings

- Process return, pay, or pay-and-adjust decisions on any device

- View and export reconcilement information

- Gain peace of mind for protection of funds

- Maintain records easily with up to a year’s worth of history

ACH Debit & Credit Positive Pay

Next-Generation Account Protection

Due to the increased volume of electronic transactions, ACH fraud has grown exponentially. Step up your account security and fraud protection with ACH Debit & Credit Positive Pay. Positive Pay helps you quickly detect unauthorized ACH debit or credit transactions and flag them electronically without calling customer support or visiting a banking center.

How ACH Debit & Credit Positive Pay Works

ACH Positive Pay triggers an actionable alert when an unapproved ACH transaction hits your account, enabling you to prevent the processing of that transaction. This real-time approval process, which can occur before a transaction posts, allows you to easily identify valid transactions and automatically populate an ACH filter for future transactions, eliminating the need to maintain ACH blocks and legacy, labor-intensive ACH filters.

Features that keep you in control:

- Stay in the know regarding ACH activity with convenient, configurable alerts

- Seamlessly access Positive Pay through digital banking

- Gain control over authorized transactions for both business and consumer account holders

- Save time by quickly and easily adding originators to approved and blocked lists

- Ensure instructions are systematically carried out with default pay/return settings

- Seamlessly access the platform with single sign on for digital banking

- Provide peace of mind for protection of funds

37%

Increase in respondents reporting

payments fraud via ACH debits

(Source: 2022 AFP Payments Fraud and Control Survey)

Positive Pay Products and Fees

Frequently Asked Questions

Why should I enroll in Positive Pay?

Unfortunately, fraudsters and scammers act quickly and rely on accountholders not reviewing their transactions closely or frequently. Banks only have a 24-hour period to reverse any potential fraud. So having a tool that sends daily alerts to analyze transactions could potentially save you thousands and a headache. The $50 subscription fee could pay for itself off with only one fraudulent $600 charge.

How do I enroll in Check, ACH Debit or Credit Positive Pay?

If you are already enrolled in Business Digital Banking, please call 636-940-5555 and request to speak to product support to be enrolled in Positive Pay. The enrollment process takes only a few minutes.

What if I flag a payment as fraud but later find out that it is not?

Users can change their decision and pay for the item themselves before 10:30 a.m. However, we cannot guarantee those funds will be returned.

Will the bank reimburse me if fraud occurs on my account when I enable Positive Pay?

If you are checking your account online every day and reviewing alerts from Positive Pay, you should be able to catch all fraudulent transactions. Users can change their decision and pay for the item themselves before 10:30 a.m. However, call product support at 636 -940-5555 as soon as possible should fraud occur.

Can I just enable Positive Pay for ACH debits and not checks or vice versa?

Yes, but we strongly encourage enrollment in ACH debit and check Positive Pay to avoid taking the liability for a fraudulent ACH or check transaction.

Can Positive Pay send alerts to more than one email?

Yes! Call product support at 636-940-5555 if you need help setting up multiple alerts or a Positive Pay feature.

How can I help prevent check fraud?

- Check your transactions daily to ensure all ACH debits and checks posted to your account are legitimate.

- Review transaction details to ensure the dollar amount, check number, and payee info are correct.

- Review check images to ensure authenticity.

- Provide consistent oversight over individuals writing checks in your organization and individuals verifying transactions. We recommend you provide a separate person to verify transactions from the individual who writes checks as an added security measure.

- Review peer-to-peer cash transactions daily if your business relies on tools like Venmo, Zelle, or CashApp.

- Set procedures to lower the possibility of your mail being stolen. Retrieve your mail promptly and review its contents to ensure checks are not lying around where they can be stolen. If mailing a check, drop these off directly at the post office instead of collecting them in a place accessible by others pre-shipment.

How do I enroll in Business Digital Banking?

- Go to Digital Banking

- Under Log in, click “Business Banking Enroll”

- Once you have read the disclosure, click “I have read the above disclosure, agree to the terms and would like to proceed with online registration” and “I Agree”

- Fill out the form and click “Continue”

Please allow 1 – 2 business days for for Business Digital Banking to be activated.

All products and services are subject to approval, including credit approval.