Savings

Everyday savings made simple, along with money market and health savings accounts for specific needs.

Our banking and mortgage centers will be closed Monday, January 19, in observance of Martin Luther King Jr. Day. You can still access your deposit accounts through Digital Banking or by visiting a First State Bank ATM.

FDIC-Insured - Backed by the full faith and credit of the U.S. Government

Checking with perks or just the basics.

Earn interest and checking account bonus rewards.

Get perks plus no monthly minimum and low fees.

Keep it simple with this low-cost checking account.

Build your balance with no overdraft fees holding you back.

Find the checking account that fits your life.

Enjoy the added benefits of a top-tier account.

Everyday savings made simple, along with money market and health savings accounts for specific needs.

Put your financial wellness first with options from basic to health savings accounts.

Open our basic savings account if you want low (or no) fees.

Give family members under 18 a savings account head start.

Step up your savings with a high-yield money market account.

Got a high-deductible health plan? You're eligible for an HSA.

Explore options to reduce your mortgage rate or monthly payments and consolidate credit card debt, or fund other financial goals.

Auto loans to credit builder loans–borrow with confidence from your local bank.

Buy a new car, truck, or SUV, or refinance an auto loan.

Finance your adventures on open waters or the open road.

Get behind the wheel of your dream RV at a great rate.

Reduce your rate and increase your borrowing power.

Get the rate and flexible terms. No collateral needed.

Build or rebuild your credit history and your credit score.

Bank online or on the go—free e-statements and digital wallet included.

Manage your finances whenever, wherever.

Go paperless. Cut clutter and enhance security.

Go cashless with our safe, convenient virtual wallet.

Check your credit score and protect your credit.

Send and receive money the fast, safe, and easy way.

Send and receive wire transfers safely and securely.

Low fees and minimums, high degrees of automated banking.

Cash management tools, plus credits to offset fees.

Easy interest and operating expense management.

For small to mid-size businesses with low volumes.

Find the account that helps grow your business.

The documents you'll need for your type of business.

Prevent check and ACH fraud from spoiling a good day. Access ACH Debit & Credit Positive Pay via digital banking to help combat fraud.

Start-up funds, working capital or financing for expansion, serviced in house.

Owner-occupied or investment, fixed or variable rates.

Flexible terms with fixed or variable rates.

Flexible terms with amortizations coordinated to the equipment's useful life.

Provides working capital for growing businesses.

Longer terms and low fixed rates for Missouri-based businesses.

Long-term, fixed-asset loans for land, building, and/or equipment.

Experts to help customize your loan for your unique needs.

Finance your commercial real estate project with the people's choice for "best commercial bank" and "best bank."

Prevent check and ACH fraud from spoiling a good day. Access ACH Debit & Credit Positive Pay via digital banking to help combat fraud.

Finance your commercial real estate project with the people's choice for "best commercial bank" and "best bank."

Finance your commercial real estate project with the people's choice for "best commercial bank" and "best bank."

Explore options to reduce your mortgage rate or monthly payments and consolidate credit card debt, or fund other financial goals.

Prevent check and ACH fraud from spoiling a good day. Access ACH Debit & Credit Positive Pay via digital banking to help combat fraud.

Everyday savings made simple, along with money market and health savings accounts for specific needs.

Finance your commercial real estate project with the people's choice for "best commercial bank" and "best bank."

Checking with perks or just the basics.

Everyday savings made simple, along with money market and health savings accounts for specific needs.

Put your financial wellness first with options from basic to health savings accounts.

Invest in your future with a safe, secure CD or IRA. Lock it in and let it grow.

Explore options to reduce your mortgage rate or monthly payments and consolidate credit card debt, or fund other financial goals.

Auto loans to credit builder loans–borrow with confidence from your local bank.

Rewards, cash back, cash-secured—find what you want in a credit card right here.

Grab cash or pay with a swipe or tap from your checking or savings account.

Bank online or on the go—free e-statements and digital wallet included.

Partner with a local bank that's invested in a lifetime of financial wellness.

Power save with our limited-time money market and CD special offers.

Low fees and minimums, high degrees of automated banking.

Make your funds work harder to meet your short-term needs.

Prevent check and ACH fraud from spoiling a good day. Access ACH Debit & Credit Positive Pay via digital banking to help combat fraud.

Cash back, rewards—and more of what you want in a business credit card.

Grab cash or cover everyday expenses, everywhere Visa® is accepted.

Experience the latest point-of-sale system with Clover from Fiserv.

Start-up funds, working capital or financing for expansion, serviced in house.

Finance your commercial real estate project with the people's choice for "best commercial bank" and "best bank."

Bank anywhere—all the essential money management tools included.

Partner with a local bank that's invested in a lifetime of financial wellness.

Prevent check and ACH fraud from spoiling a good day. Access ACH Debit & Credit Positive Pay via digital banking to help combat fraud.

Power save with our limited-time money market and CD special offers.

Finance your commercial real estate project with the people's choice for "best commercial bank" and "best bank."

Partner with our expert business lenders for a personalized experience.

Finance your commercial real estate project with the people's choice for "best commercial bank" and "best bank."

Home loans serviced in-house with the one-on-one attention you deserve.

Explore options to reduce your mortgage rate or monthly payments and consolidate credit card debt, or fund other financial goals.

Take an expert guide on your homeownership journey.

Calculators and an in-depth glossary to keep you informed.

Ready to make an offer? So are we. See what's new.

Find a banking or mortgage center near you.

Email, call, or pay us a visit. We'd love to see you.

Prevent check and ACH fraud from spoiling a good day. Access ACH Debit & Credit Positive Pay via digital banking to help combat fraud.

Take a trip down memory lane all the way back to 1867.

Everyday savings made simple, along with money market and health savings accounts for specific needs.

Learn about our commitment to community support.

Finance your commercial real estate project with the people's choice for "best commercial bank" and "best bank."

Pursue a career with purpose, possibility, and people who care.

All In: Shared Purpose for Lasting Impact

Reflecting on the past year, I am filled with immense pride and gratitude for the unwavering support and dedication of our community, customers, and employees. At First State Bank, we believe that our advantage is the dedication we demonstrate to the communities we serve. To us, it’s not about saying we care, it’s about showing it every day.

This year, as we gear up to launch our new website, we’ve been reflecting on our journey. While our brand has undergone a transformation over the years, we’ve stayed true to our roots. In this annual report, we’re excited to unveil our new mission and vision that’s driven by our organization’s core values. These guiding principles are not just words on paper; they are the foundation of our commitment to you and the communities we serve.

I invite you to also check out the accompanying video where I share more about our journey and successes from the past year.

Thank you for being a part of our journey. Together, we will continue to navigate financial milestones with confidence and ensure prosperity for future generations.

Warm regards,

President & CEO, First State Bank

Moving Forward, Together

At First State Bank, we’ve taken a moment to reflect on our history and see how far we’ve come as an organization.

Although technology has dramatically changed how we operate as a bank, our commitment to service has remained the same. Through collaborative workshops with employees at all levels, we identified our shared beliefs, purpose, and long-term goals. We are now proud to share the new core values, mission, and vision statements that will unify our team.

Your Confidence, Our Commitment

Trust isn’t a given; it’s earned—every day, in every interaction. We don’t just hold your money; we hold your confidence. That means honest conversations, clear guidance, and decisions that put your best interests first. When we say we’re here for you, we mean it.

Built on Principles, Not Shortcuts

We don’t chase trends, cut corners, or make promises we can’t keep. Our word is our bond, and our handshake still means something. At our core, integrity is about being accountable to you, our team, and the community we serve—because doing right by people is the only way we do business.

Investing in the Places We Call Home

This isn’t just where we do business—it’s where we live, where our kids go to school, and where we invest our time and resources. With deep roots in the communities we serve, we’re committed to helping local businesses grow and supporting families at every stage of life. Banking should feel personal because it is, and we’re here to grow alongside the communities we call home.

We entered 2025 with a renewed sense of purpose and a fresh outlook for the future, all with the goal of being stronger as a team. Informed by our core values, we developed a mission statement that is grounded in the present, reminding us of our purpose, who we serve, and how we serve them.

While the mission is based in today, we also needed a future-driven statement that keeps us focused on our long-term goals. The vision statement we’ve developed inspires us to do the work that matters most, reminds us of our intentions, while lending a framework for strategic planning.

These statements are more than just words; they reflect our dedication to building a bank that invests in its customers and community. We invite you to share your thoughts and experiences with us, as your feedback is crucial in helping us live up to these values every day.

Through genuine relationships, expert guidance, and a deep commitment to reinvesting in our community, we help you navigate financial milestones with confidence—because when you succeed, we all do.

Our vision is to never lose sight of our purpose—serving people, strengthening communities, and ensuring prosperity for future generations.

As a rabbi, I especially appreciate the emphasis First State Bank places on financial education and ethical prosperity. Empowered people make informed decisions that help build a brighter future for our entire community.

Rabbi Chaim Landa, Chabad Jewish Center of St. Charles County

Invested Here

At First State Bank, we believe that a strong community starts with a strong, independent local bank. As the banking industry becomes more transactional in nature, we still take the time to get to know our customers and their families, advocate for their goals, and provide solutions that empower them to build a strong financial future. Our experienced team is uniquely equipped to advocate for our diverse customer base, helping them navigate complex financial decisions with confidence. Our loan committee lives and works locally, lending to industries, businesses, and individuals that may have been overlooked at larger institutions, while helping to maintain our long legacy of financial stability. Together, we are investing in a brighter future for our community—one that is rooted in trust, integrity, and a deep commitment to ethical prosperity.

But what is ethical prosperity? It’s about financially investing in our community—reinvesting deposits into loans that benefit our local economy. It’s about cultivating relationships with government officials, federal regulators, and community partners.

These relationships help us advocate for policy that positively impacts community banks like ours, help us navigate the complexity of our highly regulated industry, and keep us active and engaged in local initiatives. Whether we’re educating a college student on building their credit or investing the time to help develop our municipality’s 10-year plan, we’re involved, we’re invested, and we care.

Our commitment to ethical prosperity is exemplified by our bank president, Luanne Cundiff, who serves as the chairperson of the Federal Reserve’s Community Depository Institutions Advisory Council (CDIAC). This unique position allows First State Bank to provide feedback on nationwide policy decisions that impact our community bank and the local economy. By advocating for initiatives that benefit small businesses, make housing more affordable, and address the diverse financial concerns of our customers, we ensure that our community thrives.

First State Bank and Luanne’s commitment to community banking is proven specifically through her role at the CDIAC. The input of our current economic state, lending conditions, and other issues happening in our hometown is important for the Board of Governors to hear.

Renee Vogelgesang, SVP, Risk Management and Commercial Lending

First State Bank is in the business of creating opportunities close to home—not just for its employees, but for everyone who banks with us. In fact, in 2024, up to 94% of our deposits were reinvested in the local communities we serve. As we grow, your deposits help us to support local businesses, homebuyers, and community initiatives.

“It isn’t often that you get to see your banker at festivals, at the grocery store, and walking down Main Street. To me, First State Bank is more than just a banking relationship, they are part of the fabric of what makes St. Charles great. They reinvest the funds they manage back into our community, strengthening us all.”

Mark A. Hollander, Executive Director, Vision Leadership

We’ve long been committed to being an independent bank and we’re proud to say we’ve never been acquired. Our bank isn’t a branch of a big corporation that invests its deposits outside of our community. We’re deeply rooted in the communities where we serve, and our decisions are made with the best interests of our neighbors in mind—not outside investors. Our unique position as an independent bank with an Employee Stock Ownership Plan (ESOP) means we can keep jobs and financial resources in our community.

As an organization, we make a concerted effort to reinvest in our local economy—starting with children making their first deposit, to new homeowners, to retirees visiting a thriving local breakfast spot. Our loan committee lives and works in the same community we do. Every day, we make decisions focused on facilitating the right opportunities so locals can grow.

Mary Alsup-Niedegerke, Executive Vice President of First State Wealth Advisors, embodies our bank’s commitment to our customers’ growth. Mary’s 35 years of expertise has propelled her to the top 1.4% of all LPL bank and credit union financial advisors and put our bank in the top 7% of all LPL Institution programs combined.

Our ESOP gives employees a stake in the success of the bank. That means we truly get to know our customers and their families—helping prepare them for life’s milestones. We offer a level of service that’s simply hard to find elsewhere. (Just drop-in without an appointment, and you’ll see why!) Our commitment to your financial success is sincere because we live where you do. When you bank with us, you’re working with people who care just as much about this community as you do.

“I’m proud that our community bank is certified dementia and aging-friendly. I want to get the word out that First State Bank truly cares about our older customers and those affected by dementia. We want them to be treated with respect every time they walk through our doors and that’s why our team is trained to provide them the thoughtful service they deserve.”

– Jill Scott, Business Development Officer

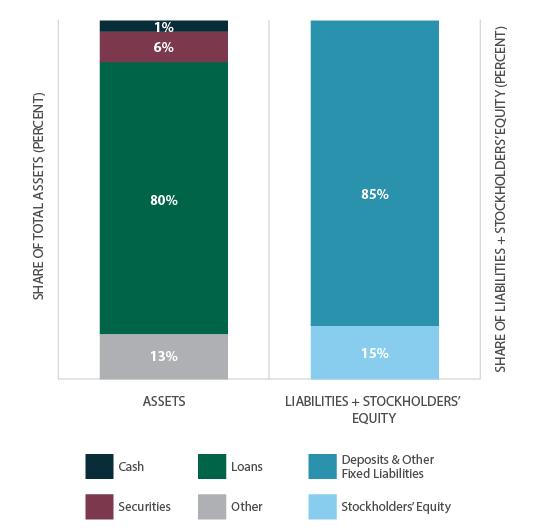

Financials

December 31, 2024 (Audited)

| ASSETS | |

| Cash and Due From Banks | $ 7,017,197 |

| Investments in Available-For-Sale Securities, at Fair Value | 33,892,158 |

| Restricted Stock, at Cost | 18,423,450 |

| Mortgage Loans Held for Sale | 16,276,859 |

| Loans Receivable | 436,138,751 |

| Less: Allowance for Loan Loss | (6,622,502) |

|

Net Loans

|

429,516,249 |

| Accrued Interest Receivable | 1,933,092 |

| Premises and Equipment, Net | 6,099,243 |

| Life Insurance Contracts, at Cash Surrender Value | 9,311,002 |

| Deferred Tax Assets, Net | 833,369 |

| Intangible Assets, Net | 5,795,752 |

| Other Assets | 7,186,102 |

|

Total Assets

|

$ 536,334,473 |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| Noninterest-Bearing Deposits | $ 101,603,323 |

| Interest-Bearing Deposits | 289,334,789 |

|

Total Deposits

|

390,938,112 |

| Federal Funds Purchased | ‐ |

| Federal Home Loan Bank Advances and Repurchase Agreements | 57,210,000 |

| Accrued Interest Payable | 1,190,633 |

| Lease Liability | 352,403 |

| Accrued Expenses and Other Liabilities | 6,581,361 |

|

Total Liabilities

|

456,272,509 |

| Common Stock | 10,155,000 |

| Retained Earnings | 92,330,924 |

| Treasury Stock, at Cost | (19,410,399) |

| Accumulated Other Comprehensive Income | (3,013,561) |

|

Total Stockholders’ Equity

|

80,061,964 |

|

TOTAL LIABILITIES

AND STOCKHOLDERS’ EQUITY

|

$ 536,334,473 |

Our bank’s robust capital position makes us a secure and reliable place to keep your money. With the financial strength to absorb losses, we’re positioned to remain solvent during economic downturns, keeping your money safe and protected.

December 31, 2024 (Audited)

| INTEREST INCOME | |

|

Total Interest Income

|

$ 29,114,909 |

| Interest Expense | |

|

Total Interest Expense

|

10,510,613 |

|

Net Interest Income

|

18,604,296 |

| Provision for Possible Loan Losses | ‐ |

| Net Interest Income After Provision for Possible Loan Losses | 18,604,296 |

| NONINTEREST INCOME | |

| Mortgage Banking Revenues | 18,675,542 |

| Brokerage Fees and Commissions | 2,176,658 |

| Other Noninterest Income | 1,025,897 |

|

Total Noninterest Income

|

21,878,097 |

| NONINTEREST EXPENSE | |

| Salaries and Employee Benefits | 23,660,485 |

| Occupancy and Equipment Expense | 1,731,599 |

| Data Processing Expense | 3,100,691 |

| Other Noninterest Operating Expenses | 3,519,560 |

|

Total Noninterest Expense

|

32,012,335 |

| Income Before Income Taxes | 8,470,058 |

| Provision for Income Taxes | 1,562,932 |

| NET INCOME | $ 6,907,126 |

David P. Strautz

Retired CEO

First State Bank of St. Charles

Jim Droste

Retired President

Al Droste & Sons Construction

Luanne Cundiff

President & CEO

First State Bank of St. Charles

Chris Goellner

President

Goellner Printing

Jennifer Bouquet

President

J&J Boring, Inc.

Jill Kluesner

Vice President &

Chief Financial Officer

Lighthouse for the Blind

Ray Bayer

Retired President & CEO

MOHELA

Michael Eagan

Retired Senior Vice President

Advanced Technologies Group

John W. McClure

Retired Bank Executive

Mercantile Bancorporation