Savings

Everyday savings made simple, along with money market and health savings accounts for specific needs.

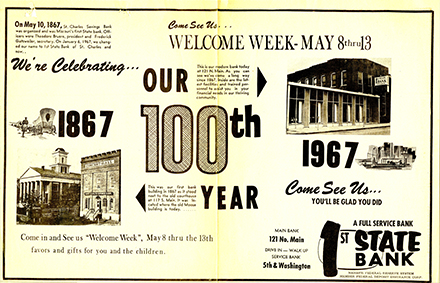

Take a trip down First State Bank memory lane as we trace our history back to 1867. Wow, we’ve come a long way together.

Community leaders gather to “form and organize an association for banking purposes.” Christened “St. Charles Savings Bank,” the bank gives a growing community a safe place to store cash and secure loans. Five weeks later, the bank receives its official charter.

St. Charles Savings Bank opens in Concert Hall on South Main Street with nine directors, three officers and $100,000 in capital. Theodore Charles Bruere Sr. becomes the community bank’s first president and serves for 39 years.

A devastating tornado destroys the bank’s first branch in Concert Hall. Two night watchmen in the building survive by climbing under their beds. Within a week the bank is back in business in “temporary” quarters next door. St. Charles Savings Bank does business for more than two years in that location.

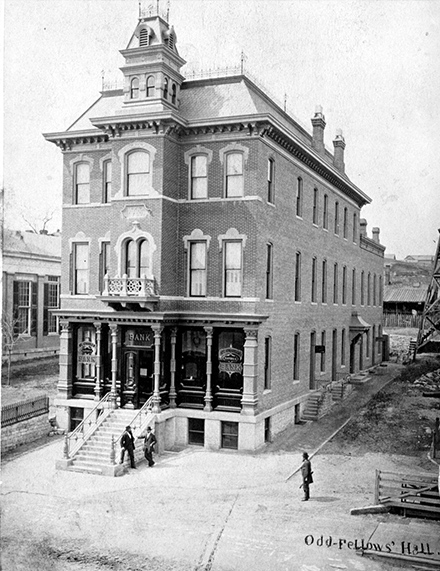

New local bank offices open in Odd Fellows Hall at 117 South Main Street. The bank leases the front part of the first floor, which measures 35’ wide by 25’ deep. An attorney and bank president Theodore Charles Bruere, Sr. rent an adjoining room where Bruere ran his law business.

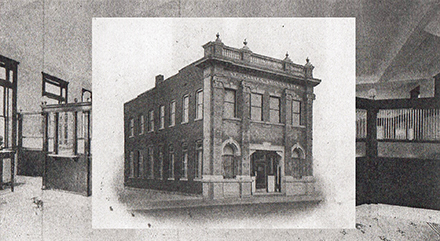

The bank moves to 121 North Main Street.

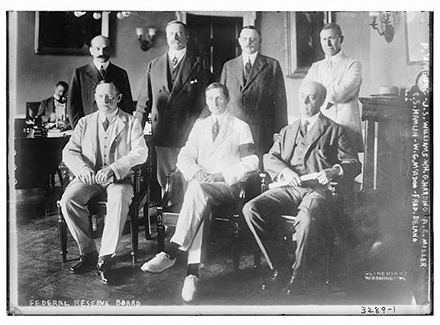

The new Federal Reserve System provides the nation with a safer and more flexible yet stable monetary and financial system.

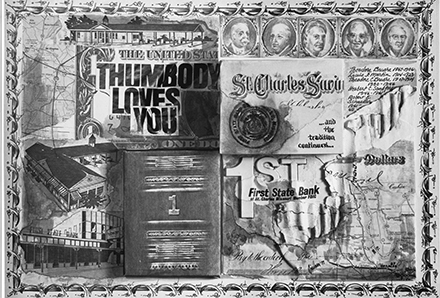

A new St. Charles Savings Bank marketing campaign promotes “courtesy is our watchword,” leading the way for a long history of exceptional customer service, as this photo from the 1970s depicts.

St. Charles Savings Bank withstands the Great Depression, the longest and deepest downturn in the history of the United States. An estimated 9,000 banks failed during the 1930s. President Franklin D. Roosevelt signs the Banking Act of 1933, establishing the FDIC to preserve and promote public confidence in banks by insuring them.

St. Charles Savings Bank becomes First State Bank, marking its 100th anniversary and better reflecting its status as a full-service independent community bank. Extraordinary bank growth follows, spurring an expansion of the Fifth and Washington Street location.

First State Bank rolls out the I’m Thumbody® campaign to let bank customers know they are as individual as fingerprints.

Jean Droste and Cordelia Stumberg join First State Bank’s board of directors, the first women to serve in this role. Meanwhile, a car loan promotion awards 50 gallons of free gas to customers who take out a First State Bank auto loan.

The bank moves its headquarters from Main Street to a new bank building at Fifth and Washington, still in the central business district but four times larger.

First State Bank signs an agreement with INVEST Financial Corporation to offer wealth management products.

Residents and businesses of O’Fallon, MO, get a new community banking center.

First State Bank offers an ATM/check card product line.

First State Bank unveils its first website and introduces online banking, and electronic payments outnumber paper checks as electronic chips made credit cards and debit cards more secure.

First State Bank replaces the existing Highway 94 facility with a complete branch office.

The Lake St. Louis branch opens in response to the need for a local community bank. The bank branch is conveniently located near the Meadows Shopping Center adjacent to the I-64/40 corridor.

The bank acquires a mortgage group to grow mortgage lending in St. Charles County, St. Louis County (Chesterfield) and Osage Beach (Lake of the Ozarks).

First State Bank connects with customers for the first time via Facebook.

The St. Louis Cardinals clinch the MLB World Series against the Texas Rangers.

The bank opens the Chesterfield mortgage office to support strategic growth of the mortgage business through expanded market coverage.

Two loan production offices open in the Kansas City area to expand the bank’s market presence.

The Chesterfield (Baxter Road) branch opens, adding another branch located outside St. Charles County.

The Phoenix, AZ, mortgage office hosts an open house at their new facility, the first outside the Midwest.

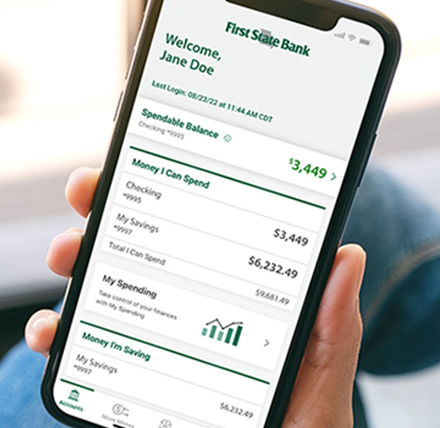

Mobile banking services are enhanced with the launch of a branded First State Bank of St. Charles app for iPhone, Android, and tablet devices.

President and CEO of First State Bank Luanne Cundiff meets with other community bankers at the White House to discuss the regulatory challenges affecting community banks.

First State Bank celebrates 150 years of serving the community’s financial needs with a rededication ceremony and a pledge to volunteer 150 days at community nonprofits. Employees more than double the goal with 310 days.

First State Bank’s INVEST team of financial advisors becomes First State Wealth Advisors.

First State Bank offers more convenience to customers by accepting digital mortgage loan applications.

First State Bank makes sending money to family and friends fast, safe and easy by partnering with Zelle.® Months later, the bank helps local businesses secure Paycheck Protection Program (PPP) loans to stay afloat during the pandemic.

The Customer Care Center opens to provide rapid resolution to inquiries and enhanced service by a centralized, knowledgeable team.

First State Bank expands retail banking into Kansas with a new banking center in Leawood. Conveniently located adjacent to the 6800 College Boulevard mortgage office, the branch serves consumers and businesses in the greater Leawood/Overland Park area.

The Gladstone, MO, mortgage office opens to serve customers in the northern Kansas City metropolitan area.

Account security is enhanced with the addition of free text alert fraud monitoring service for First State Bank debit cards.

Both online banking and the mobile banking app get upgrades to include balance monitoring, credit reporting, live chat support and more new features.

First State Bank procures Positive Pay fraud protection for businesses to help protect accounts against fraudulent checks and ACH transactions.